As I settle back in and unpack from a very successful trip to Palm Beach, I can’t help but reflect on how substantial I have become. |

We boarded the plane and sat in our first class pods and I was overwhelmed with gratitude! I really have the 22-year-old version of me to thank, who lived in Economy Plus, survived middle seats, and treated the Delta Sky Club like a second home… all due to my role in consulting. |

Those were formative years. Years of discipline. Years of 5 a.m. boarding groups, client-site redeyes, and emotional resilience. All so that my 30s, and frankly the rest of my natural life, could be spent at the highest tier of airline status known to man (when forced to fly commercial). |

Was suffering through consulting worth it?

Palm Beach delivered, per usual. Wifey enjoyed a post-lunch, Sancerre-bucket nap, face-down in the sand.

Shhh, Wifey is sleeping

The kiddos dug in the sand, and somewhere between The Breakers and the shoreline, I turned to Tarantino (4, gifted) and said, “You diggin to China, bud?”

He didn’t even look up.

“Dad… not in this geopolitical climate”

Proud moment. Global awareness. Capital-preservation instincts. The next generation is already thinking in terms of risk, exposure, and unnecessary international entanglements. Exactly what you want before kindergarten.

We are so fortunate that Choate has the #1 ranked Pre K Model UN Program in the country

Before you read this, please know that this story made me roll my eyes so far into the back of my head that I burst a blood vessel and had to call my concierge doctor to the house.

Up in the Adirondacks, which I hear is like Aspen for your brother in law that works retail, residents of a 165-unit manufactured home park just successfully blocked a private equity buyout using New York’s new right-of-first-refusal law. Instead of selling to out-of-state capital, the community banded together, formed a homeowners association, found local financing, and purchased the park themselves.

These people think they can stop us

ANNNND the “PE vultures are coming” crowd cracks open a cheap bottle of warm champagne. Of course they’re thrilled. Because they’re fearful about what might happen if ownership changes hands, especially if it turns over to private equity. That fear isn’t unique to one tiny Adirondack park; it’s a symptom of a larger pushback against institutional investors in residential real estate, mobile home parks, and single-family homes. States like New York are stacking the deck with waiting periods, right-of-first-refusal laws, and other legislative tools aimed squarely at keeping big investors at bay.

Would any smart private equity firm absolutely level these shacks and build a luxury condo complex with a med spa in it? You bet.

What is Better?

Private equity has literally helped preserve communities through buy-and-hold capital, upgrades (sometimes leveling and building casinos on top), and long-term asset strategy. But the narrative has tilted toward distrust, driven not by actual performance metrics but by optics and political incentives. So what we’re really watching isn’t a one-off Adirondack victory; it’s the beginning of a sustained resistance movement against capital that doesn’t behave like private equity… or at least doesn’t look like it. That’s the bigger trend everybody should be paying attention to.

We found out Valentino died from the news just like the rest of the general public. I found this to be odd because Wifey is one of the brand’s top customers. She owns millions of dollars of Valentino. She’s got archive pieces vintage runway gowns, etc.

Wifey literally has his personal cell phone number in her phone. So yes, it was a little jarring to learn about his passing via a push notification like a civilian. Anyway, she is wearing black today. Valentino head to toe in honor.

PE Recruitment Cycle Ramps Back Up

I’m thrilled to report that on-cycle private equity recruiting is officially back. Interviews. Offers. Back-to-back technicals. Sleep deprivation. Group chats melting down. The whole beautiful ecosystem of professional hazing is coming back online. Nature is healing. Capital is confident again. And nothing says “the market is open” like 23-year-olds being asked to model an LBO on two hours of sleep.

He is yet to accept my Linkedin Connection Request, CURIOS

Honestly, reading about firms restarting the on-cycle process took me right back to the absolute bloodbath that was recruiting out of HBS Harvard Business School. A spiritual endurance test disguised as career development. Conference rooms full of emotionally fragile overachievers. Rejection emails hitting harder than margin calls. It was ruthless. It was chaotic. It was formative. And it is precisely why some of us are built different.

So to the next generation of candidates: welcome back to the arena. Get comfortable with rejection. Get familiar with silence. Learn how to smile while being told you’re “very impressive” and then never hearing from anyone again. Because private equity is not supposed to be accessible. It is supposed to be something you claw your way into. And frankly, I’m relieved the kids are finally getting the full experience.

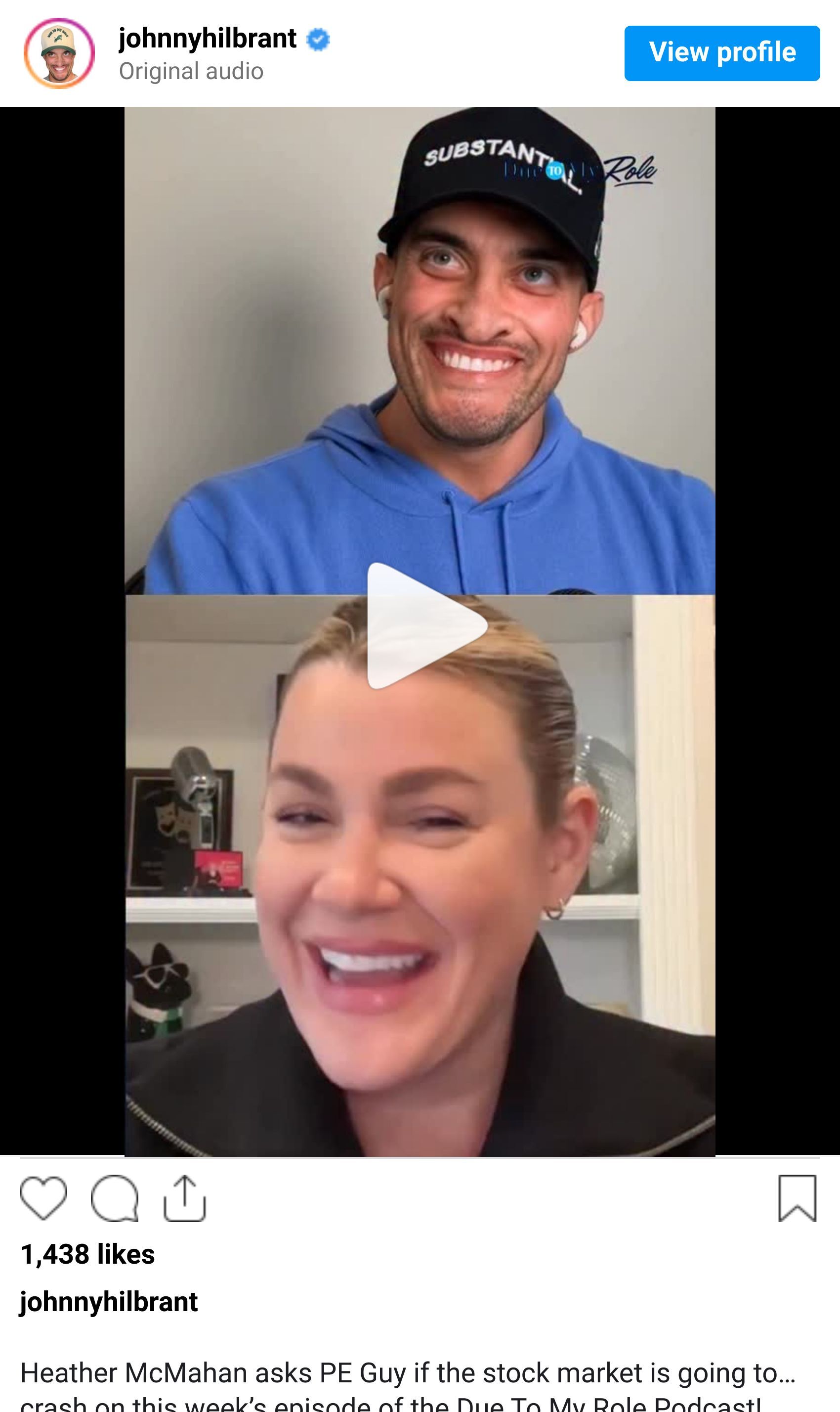

Heather McMahan asks PE Guy if the stock market is going to crash on this week’s episode of the Due To My Role Podcast! 5 minutes of this nonsense and 30+ minutes of an amazing conversation about Heather’s continued success!

Subscribe accordingly for substantial founders, comedians, and interesting people on the internet with decent stories and substantial exits.