I have been shopping for a new Au Pair for Tarantino and Montauk since it was recently revealed that Genevieve knew less about tone, pitch, and range than wifey’s tennis instructor knows about lower back health and proper pelvic stretches. Anyway, that is the last time I take a nanny recommendation from the Zuckerbergs.

In the absence of proper musical instruction from Genevieve for the Kiddos, I will fill the void

After my analyst conducted due diligence about child care options, I was shocked to find out that more than 90% of the US population somehow raise children, without a trilingual Ivy League-educated au pair. In fact, most people have been dropping their kiddos off at “Learing Centers”, which have suddenly become my newest favorite asset class. Turns out, these things are ABSOLUTELY PRINTING MY MAN!

For the life of me, I could not figure out how to schedule Tarantino’s admission interview

I haven't found recurring revenue and margins like this since I rolled up every senior center in Mississippi and sold them to the Waffle House family office. It’s so rare to find an asset class that realizes you do not need employees or even customers to make a profit. When culture and values are this aligned, I am disappointed to find out that PE, Private Equity, has yet to get involved.

However, I think these Learing Centers are harder to get into than Groton or Exeter because I couldn't even find an admissions representative to book Montauk’s interview or Cello audition. This sort of entrance exclusively is exactly what I was looking for in the Kiddo’s next school.

And, these folks were up to par when it came to fundraising and putting that endowment to work. There was an easy drop box on the side of the building where I was assured my donation would be deployed on an international scale to ensure that the graduates of Learing Center would have reciprocity to the very best country clubs both in Minnesota and Mogadishu.

Let’s just say that Montauk and Tarantino will have no problem getting in after they see the donation I dropped off

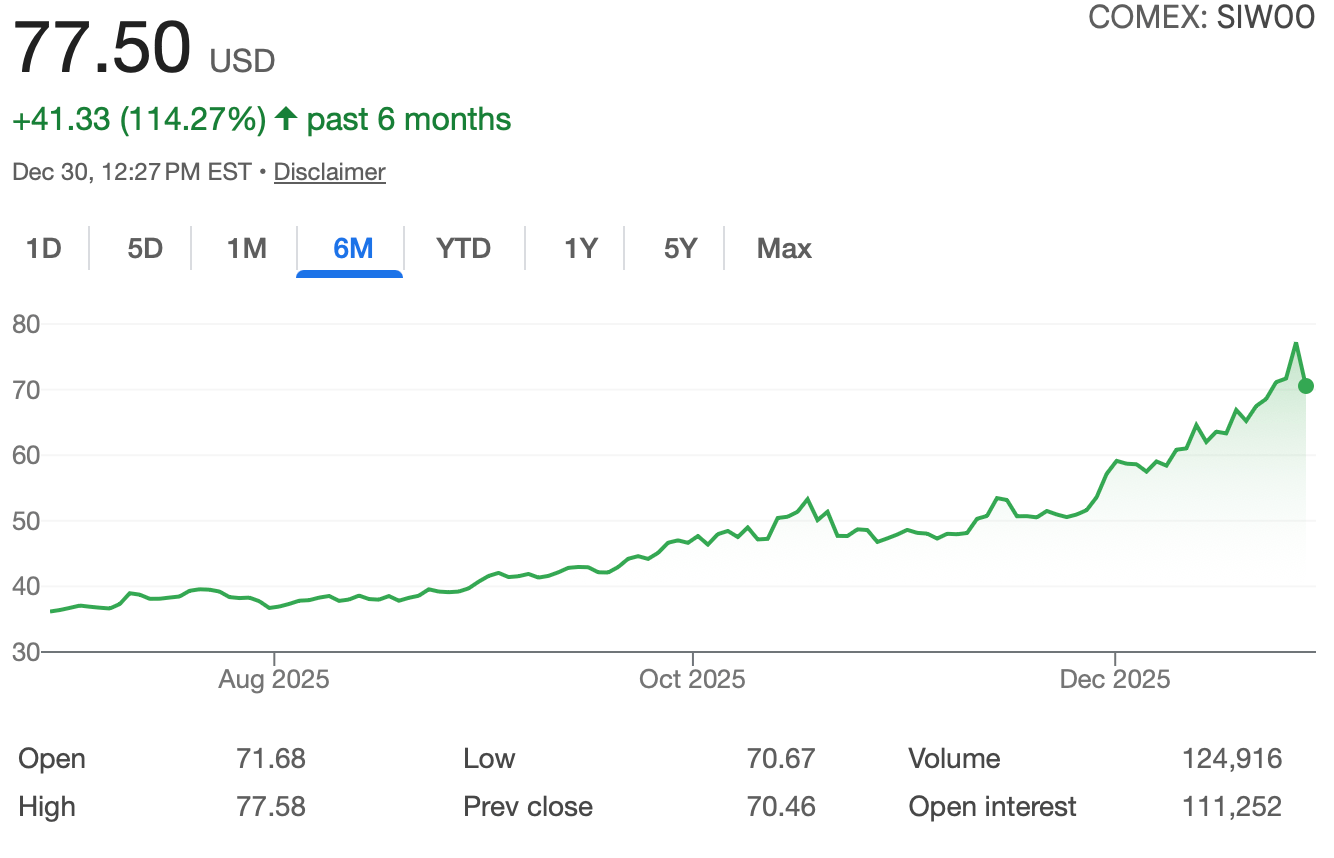

PE Guy’s Take on Precious Metals: Silver From Party Asset to Profit-Taking Panic

Just when you think markets can’t get any wilder, silver pulls another fast one. After a substantial run from sub-$30 to briefly flirting with record highs north of $80 an ounce, prices reversed and gave back a chunk of the move almost overnight. Apparently, this was “jarring” for some people. I only noticed because the alert went off during Tarantino’s enrichment block and Wifey asked if this was going to affect the remodel budget in Aspen (it won’t).

This isn’t a fundamental crash. It’s classic volatility. Fear, hype, and cheap leverage colliding in real time. Happens all the time. Just usually not right in the middle of a messy nanny firing.

Lesson? Markets may be irrational longer than you expect, but they aren’t patient. When everyone’s long, no one’s hedged, and conviction is based on vibes, gravity tends to win. Due to my role, I’ll continue explaining this to Wifey as “noise” while the kiddos remain blissfully unexposed to commodities altogether.

Is this good?

Quick piece of advice:

For all you junior analysts from non-target schools… do better and enroll in Wall Street Prep so you too can sip scotch with the elite and tell substantial stories at the Yellowstone Club.

Everything you need to learn financial modeling: DCF, Comps, M&A, LBO and Financial Statement Modeling in this all-in-one collection of modeling courses.

Click here for 20% off Wall Street Prep / Use Code CYBER202

Not to get political- I sat down with Jim Acosta, former CNN Chief White House Correspondent. The conversation was excellent except for the part where he raved about a recent trip to Portugal and I rolled my eyes. Portugal is so overdone! Been there done that 10 times over!

Jim reflected on his career inside legacy media, covering two presidential administrations. We talk about everything from being banned from bowling at the white house to interviewing Fidel Castro. It was very interesting to hear from his perspective what’s happening behind the scenes of journalism today.

Subscribe accordingly for substantial founders, comedians, and interesting people on the internet with decent stories and substantial exits.

Help Pick Child Care Options for the Kiddos:

Due to My Role is looking for the funniest PE Stories you got. Please submit a funny anecdote as it pertains to the beautiful world of private equity. Whether your local florist was sold to FLOWERCORP and you can only buy petunias on subscription now, or if you recently helped PORTCOS train AI robots to replace the senior citizen greeters at Walmart, we want to hear from you!