I was thrilled to see the news about Netflix buying Warner Bros. I love this kind of vigorous brinksmanship! You can imagine how tickled I was to see Paramount tell Warner bros shareholders that it has a smoother path to regulatory approval than Netflix does.

As the fencing referee at Tarantino’s tournaments would say: Netflix, Paramount… En Garde!

Once again, PE, Private Equity saves the American consumer time and money by consolidating all of the streaming slop into a single login so that the proletariates can stop attempting to remember so many passwords. I can only imagine how relieved you must be to not have to keep track of the login to watch Owning Manhattan and another for my 600 Pound life?

My housekeeper explained to me that this would be as if my mid century French literature was safely nestled in the study right next to my vast collection of personal hand written thank you cards from Warren Buffet. What is not to love? Yet, she warns me that not everyone is on board with this substantial deal.

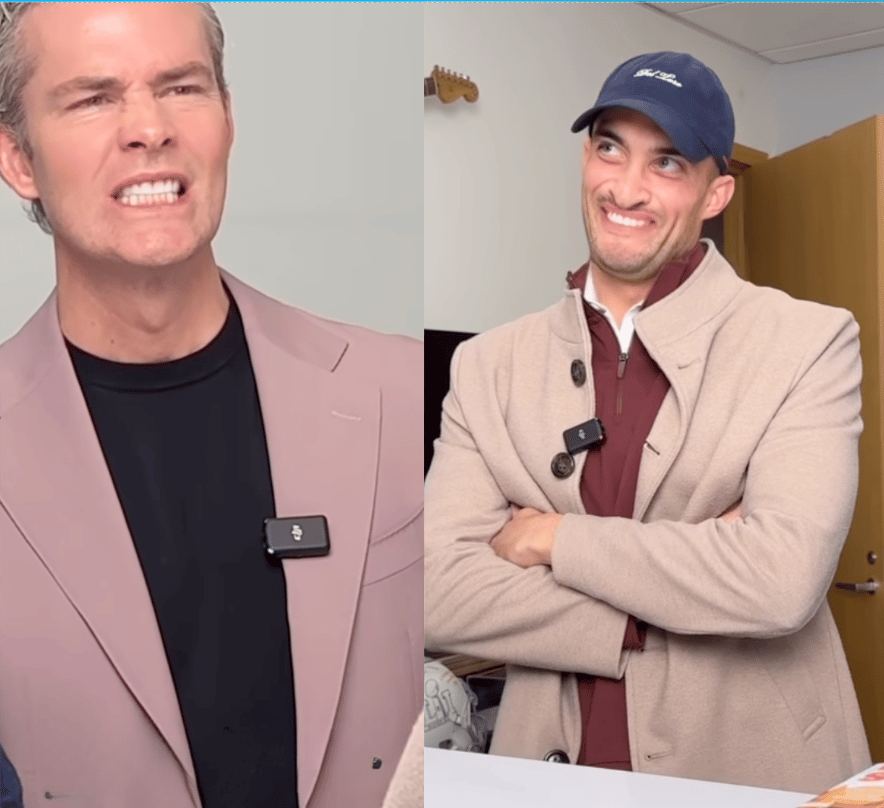

My political science professor from Choate reacting to the news that Netflix was set to purchase Warner Bros, I was able to confirm she is not on the cap table for either side.

After I was read into the Paramount/Netflix drama from Kushner, I was able to sneak around the corner to catch up with the realtor who sold me the penthouse on the Upper East Side. I wanted to take a moment and congratulate Ryan on the new show on Netflix, and alert him of our post hostile takeover lean management/cost cutting plans we have once Netflix consummates the deal. We are hopeful that season three of Owning Manhattan can be shot on an iPhone, in order to hit our projections.

Alas, I could not stay in the city for much longer because wifey reminded me that I had booked the jet to pick us up at Teeterboro at 3 PM, and we could NOT be late for dinner at the Blue Lion in Jackson Hole if I wanted to catch sit next to Harrison Ford. The early days of my career in oil and gas make my heart yearn for the west, and luckily wifey snagged my bespoke Stetson to set the mood while I stepped onto the gulf stream.

Quick piece of advice:

For all you junior analysts from non-target schools… do better and enroll in Wall Street Prep so you too can sip scotch with the elite and tell substantial stories at the Yellowstone Club.

Everything you need to learn financial modeling: DCF, Comps, M&A, LBO and Financial Statement Modeling in this all-in-one collection of modeling courses.

Click here for 20% off Wall Street Prep / Use Code CYBER202

On the plane ride into Jackson, between snuggles with wifey and cleaning up Amalfi’s accident near the cockpit, I was able to read this piece in Fortune that definitively proves PE, private equity isn’t the villain everyone thinks it is. It’s written by Will Dunham who I would like to give a tremendous kudos as soon as I am back east. GREAT WORK MY MAN! If anyone happens to know if he is a golfer (I would assume so), I would like to offer him a spot in my foursome next week at Beth Page for this thorough defense of our beloved industry, PE, private equity.

The argument is that PE, private equity returns on retirement accounts can outperform public markets. That’s music to my ears. It paints a picture where average savers might finally get a taste of the exclusive returns usually reserved for the few, while the rest of Wall Street stays asleep at the wheel.

As long as you’re willing to give up liquidity and transparency, the cash is locked, the reporting is opaque, the fees are high private markets have historically delivered superior long-term performance compared to public stocks and bonds.

The piece essentially says that, with patience (and a stomach for illiquidity), retirement funds could grow faster under private equity than under conventional public-market portfolios. In short, what tremendous work by Will. He is one of us, a real stand up guy.

But even Will cannot compete with my guest this week on the Due to My Role Podcast, Mark Sisson. Mark was the founder of Primal Kitchen, and joined me to discuss how life changes or stays the same after a SUBSTANTIAL exit.

The Health Guru Who Cashed Out for $200M — Mark Sisson

What is Your Role?

Due to My Role is looking for the funniest PE Stories you got. Please submit a funny anecdote as it pertains to the beautiful world of private equity. Whether your local florist was sold to FLOWERCORP and now you can only buy petunias on subscription, or if you recently helped PORTCOS train AI robots to replace the senior citizen greeters at Walmart, we want to hear from you!