The southwest fireplace gives off better ambient heat than any of the other 16 hearths

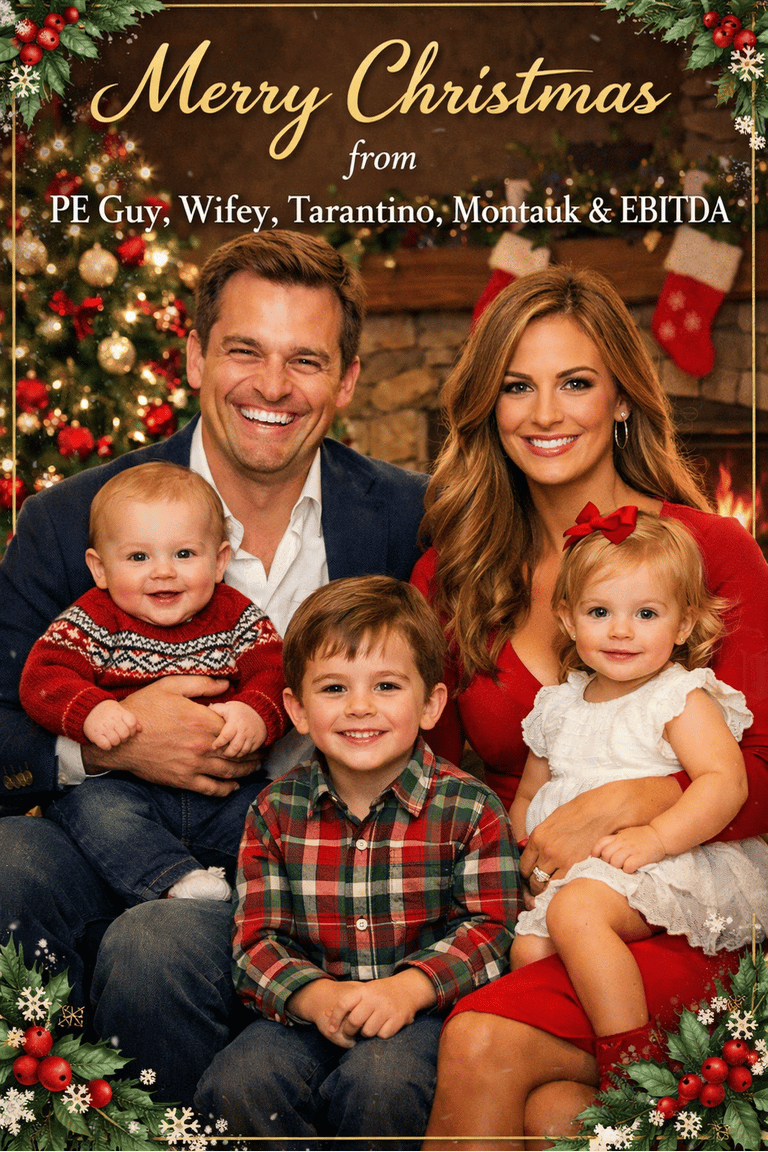

As another transformative year draws to a close, we find ourselves filled with gratitude for family, for legacy, and for disciplined execution across all verticals of life.

This year, Tarantino (4) continued to outperform benchmarks, further refining his Mandarin, equestrian balance, and early-stage leadership instincts. Montauk (2) has emerged as a true force of will. She is curious, expressive, and already demonstrating a healthy skepticism of authority. EBITDA (9 months) remains pre-verbal but highly gifted, with strong growth indicators and exceptional optionality.

We’ve cherished time together between New York, Nantucket, Aspen, Jackson Hole, Tuscany and Palm Beach. As always, we are committed to raising principled children, investing in experiences over things (though we do appreciate exceptional things), and approaching parenthood with intentionality and conviction.

Wishing you a holiday season defined by health, prosperity, and sustained upside.

Merry Christmas,

PE Guy, Wifey, Montauk, and Tarantino

Quick piece of advice:

For all you junior analysts from non-target schools… do better and enroll in Wall Street Prep so you too can sip scotch with the elite and tell substantial stories at the Yellowstone Club.

Everything you need to learn financial modeling: DCF, Comps, M&A, LBO and Financial Statement Modeling in this all-in-one collection of modeling courses.

Click here for 20% off Wall Street Prep / Use Code CYBER202

I see the usual chorus is upset again. Private equity bought something beautiful and now everyone’s suddenly a tourism ethicist.

This time it’s Blackstone acquiring Hamilton Island, and suddenly people who’ve never read a P&L are deeply concerned about “the soul of tourism.”

Here’s the reality: places like this don’t survive on nostalgia and good intentions. They survive on capital, infrastructure investment, and operators who know how to scale without letting the asset quietly rot. This isn’t PE “ruining paradise”, it’s institutional money ensuring the lights stay on, the jobs stay put, and the destination is still relevant a decade from now. Place is gonna absolutely PRINT!

I know it’s comforting to believe everything should remain “locally owned forever.”

But feelings don’t maintain airports, marinas, or balance sheets. Capital does.

Sometimes PE buying the asset isn’t the problem.

It’s the reason the asset survives.

Check out my Conversation About Life After Wimbledon and Battling the Fading Spotlight

On the latest episode of Due To My Role, I sat down with Sam Querrey and John Isner to talk about retirement and what happens after the checks slow down and the spotlight moves on.

We get into John’s 11-hour Wimbledon match that literally forced the sport to change its rules, Sam’s realization that he was effectively priced out of attending the US Open as a former professional, and how corporate money, media, and influencer culture have quietly rewritten the economics of live sports.

But the real conversation is about identity. Retirement shock. The moment your prime earning window closes, you have to rebuild relevance from scratch. Broadcasting, podcasting, investing, second acts. Hopefully, something I never have to worry about (Due To My Role).

If you care about competition, ego, money, and what happens when excellence has an expiration date, this one’s worth your time.

Subscribe accordingly.

Which best describes your Christmas situation this year?

- We have 1–2 chimneys — Cozy. Respectable. Transitional phase.

- We have 3–5 chimneys — Tasteful. Thoughtful upgrades.

- We have 6–10 chimneys — Starting to complicate Santa logistics.

- We have 11–17 chimneys — Santa needed a site visit.

- We don’t count chimneys — Someone else handles that.

- No chimneys — Traveling for Christmas (obviously).

- I asked my architect to add chimneys for symmetry — Worth it.

- I don’t celebrate Christmas but still have multiple fireplaces — Lifestyle choice.

Due to My Role is looking for the funniest PE Stories you got. Please submit a funny anecdote as it pertains to the beautiful world of private equity. Whether your local florist was sold to FLOWERCORP and now you can only buy petunias on subscription, or if you recently helped PORTCOS train AI robots to replace the senior citizen greeters at Walmart, we want to hear from you!