Due to my family’s vast network, I’ve never struggled to get a job or an interview at any Ivy League MBA program. Honestly, it’s been shockingly easy.

My Backup School was Yale

It’s also no secret that I receive significant interest from other firms offering substantial roles allocating capital across various industries.

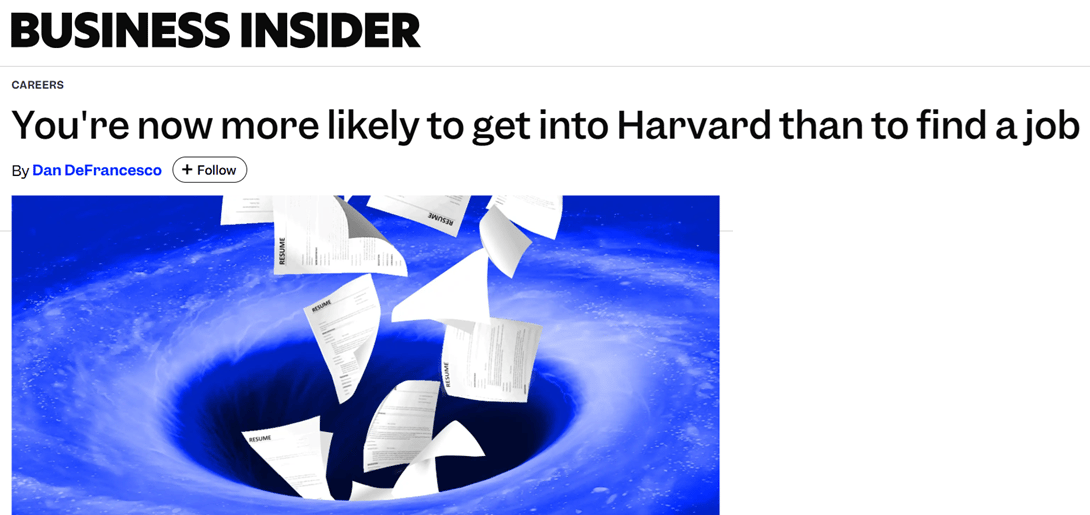

Here’s what Business Insider had to say:

The average job opening last quarter received 242 applications, per Greenhouse. That’s a 0.4% chance of landing the typical role. Meanwhile, that school near Boston sits at a 3.6% acceptance rate.

Timberlake was my HBS roommate’s third cousin, the networking there is OUTSTANDING

Frankly, I can’t relate. In my world, if you're “applying” for a job, just call your uncle in banking and have him introduce you to his buddies at the Corinthian Club.

This newsletter is powered by Zapier, because at this point, if your spreadsheets aren’t automated, your IRR should be audited. Zapier keeps our workflows running in the background, connecting tools, syncing data, and handling the repetitive stuff so we can focus on insights instead of busywork. |

Networking at a wedding in $1100 Louboutins

Recently, I had the pleasure of attending one of my business partners’ weddings. I did miss the ceremony because deal flow was on fire as we were finalizing a $600 million auto-parts deal. You’ll read about it in the Wall Street Journal in the coming weeks.

Anyway, how do you know the bride and groom?

Struggling with gift ideas this holiday season? Check out PE Guy’s favorites here:

Some Minor Snafus From My Friend’s Firms This Week, I have been assured this will not hold up our distribution checks

KKR's Rampant Safety Violations and Wage Theft Exposed: A November 6, 2025 report from the Private Equity Stakeholder Project uncovers severe labor abuses at KKR portfolio companies, including repeated OSHA citations at Refresco for hazards causing worker injuries and amputations, widespread wage theft affecting hundreds of EMTs at Global Medical Response, and KKR's refusal to engage with employees organizing for safer conditions and fair pay—exemplifying PE's prioritization of profits over worker safety and livelihoods.

Private Equity Nursing Homes' Deadly Understaffing and Overcharges: Amid a surge of PE acquisitions, Virginia's nursing home oversight board on November 14, 2025, demanded greater transparency and cost reporting to combat exploitation, as studies show PE-owned facilities charge residents $1,000 more annually while cutting staff, leading to 10% higher mortality rates, frequent neglect, falls, and infections that leave families desperate and healthcare workers overburdened.

Envision Healthcare's Surprise Billing Onslaught in ERs: Private equity-backed Envision Healthcare continues to frustrate emergency patients in 2025 by going out-of-network post-acquisition, doubling prices on captive hospital visitors unable to shop around, resulting in massive surprise bills and delayed care— a predatory tactic that burdens consumers while frontline medical staff face intensified pressure from cost-cutting measures.

What is your role?

Due to My Role is looking for the funniest PE Stories you got. Please submit a funny anecdote as it pertains to the beautiful world of private equity. Whether your local florist was sold to FLOWERCORP and now you can only buy petunias on subscription, or if you recently helped PORTCOS train AI robots to replace the senior citizen greeters at Walmart, we want to hear from you!